Published On Mar 18, 2024

401k Contribution Calculator: https://bit.ly/3VlfMc3

How to campaign for a better 401k plan: https://www.bogleheads.org/wiki/How_t...

Check Out My Recommendations (It helps support the channel):

🔥 M1 FINANCE Investing- Free $10 (once you deposit at least $100 within 30 days) https://bit.ly/427KBBn

📚 Here's a video on how to use M1 Finance • M1 Finance Investing Tutorial For Beg...

📝 NewRetirement - The retirement planning tool I personally use to make sure I'm on track with saving for retirement. It's perfect for "Do it yourself" investors https://bit.ly/3EAAhrJ

🔒 AURA - 14 day free trial to see if your personal information has been leaked online and have it removed https://aura.com/jarrad

📝 Empower - Free Net Worth Tracker https://bit.ly/3NUNtwq

📖 Free copy of my Spending Review Spreadsheet: https://bit.ly/48lMVZ1

📧 Business Inquiries: [email protected]

A 401k is a retirement savings plan sponsored by an employer. It lets workers save and invest a piece of their paycheck before taxes are taken out. Taxes aren't paid until the money is withdrawn from the account, typically after retirement.

There are two main types of 401k plans: traditional and Roth. In a traditional 401k, your contributions are made with pre-tax dollars, which can lower your taxable income and, by extension, your taxes in the year you contribute. The money grows tax-deferred, but you'll pay taxes on withdrawals in retirement. A Roth 401k works a bit differently: contributions are made with after-tax dollars, meaning there's no initial tax benefit. However, withdrawals in retirement are tax-free, provided certain conditions are met, which can be advantageous if you expect to be in a higher tax bracket in retirement.

One of the key benefits of a 401k plan is the potential for employer matching. Many employers will match a portion of your contributions, essentially providing free money towards your retirement savings. The specifics of how much an employer will match can vary widely from one plan to another.

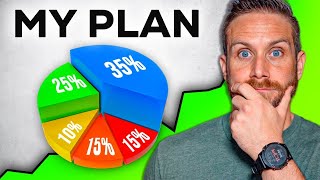

Your 401k allows you to choose from a selection of investment options, typically including a variety of mutual funds that invest in stocks, bonds, and money market instruments. The idea is to grow your retirement savings over time through these investments. It's important to consider your investment choices carefully, taking into account your retirement goals and risk tolerance.

There are limits to how much you can contribute to your 401k each year, and these limits are periodically adjusted for inflation. For people over 50, catch-up contributions are allowed, enabling older workers to contribute additional amounts to their 401k to make up for years when they might not have saved enough.

Finally, while a 401k is a powerful tool for saving for retirement, it's also subject to certain rules and restrictions regarding withdrawals. Early withdrawals before age 59½ may be subject to taxes and penalties, although there are exceptions for specific situations. As such, it's typically recommended to think of your 401k as money locked away for retirement, to avoid eroding your future financial security.

Affiliate Disclaimer: Some of the above may be affiliate links. Support the channel by signing up or purchasing through those links at no additional cost to you. I appreciate you for helping me keep this channel running.

Disclaimer: This video is for entertainment purposes only. Everyone's situation is different so do your own research before making any decisions with your money.