Published On Dec 1, 2020

🔥 Coin Bureau Trading Channel 👉 @CoinBureauTrading

📺 Technical Analysis Part 3 👉 • Technical Analysis: TOP TIPS To MAX G...

📲 Follow Our Socials 👉 https://guy.coinbureau.com/socials/

🎄 Get Your Crypto Xmas T-Shirt 👉 https://store.coinbureau.com/

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

- TIMESTAMPS -

0:00 Intro

2:02 TA & The Bull Market

4:06 Bull Flags & Bear Flags

6:00 Wedges

8:05 Double Tops, Bottoms, H&S

9:50 Fibonacci Retracement Indicator

12:19 Bitcoin Dominance

15:25 Sentiment Analysis 101

17:41 Final Thoughts

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

⛓️ 🔗 Useful Links 🔗 ⛓️

► Technical Analysis Part 1: • Technical Analysis: Everything YOU NE...

► Technical Analysis For Crypto – Beginner’s Guide: https://www.coinbureau.com/education/...

► 11 Essential Candlestick Patterns: https://www.cmcmarkets.com/en/trading...

► Bitcoin Dominance Chart: https://www.tradingview.com/symbols/C...

► Sentiment Analysis 101 And Tools List: / sentiment-analysis-in-cryptocurrency

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

📈TA & The Bull Market📉

As more and more retail investors pile in, the little amount of rationality that exists in the crypto space will become entirely undetectable. Thanks to the predictability of human emotion on which technical analysis is based, price patterns and technical indicators are going to become more powerful than ever in forecasting short term price action as the public FOMOs into crypto

📊Bull Flags & Bear Flags📊

Flag patterns consist of two things: the pole and the actual flag. A flag is drawn when price has been in a downtrend (or uptrend) in the medium term but has seen an uptrend (or downtrend) in the short term with fairly low volume

The pole to flag is drawn from the most recent high (or low) in the medium term to the candle which marks the start of the flag, and the percentage change in price you are likely to see will again be roughly the same as the percentage change of the pole. A flag is broken when the first big candlestick which breaks out of the flag is shown on the chart

📐Wedges📐

Wedges are drawn two trend lines start to converge. When this convergence happens, price can either spike to the upside or drop to the downside. A rising wedge might look bullish at first glance, but almost always results in a drop in price. In contrast, a falling wedge signals a potential swing to upside

The percentage change in the widest portion of the wedge tends to be the same degree to which price will go to the upside or downside when the wedge breaks. A wedge breaks when a candle appears that is visibly outside the range of the wedge you drew

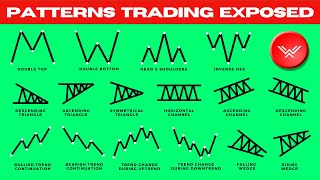

🔝Double Tops, Bottoms, H&S⏬

A double top pattern is drawn when price tries to break through a resistance level twice. This will look like the letter ‘M’. When this happens, it is common to see a drop in price that is roughly the same amount as the difference between the top and bottom of the double top

A double bottom is drawn when price bounces off a resistance level twice. This will look like the letter W. This is a bullish sign, and the approximate move to the upside can again be measured using the distance between the support and resistance lines in the pattern

A head and shoulders price pattern consists of three price peaks which all touch or almost touch a support line at the top of a medium or even long-term upwards price trend. The middle peak is large, whereas the peak on each side is smaller.

A head and shoulders pattern often signals that price is about to fall. The degree to which price will drop can again be estimated using the distance between the middle peak and the support line of the price pattern

📏Fibonacci Retracement Indicator📏

The Fibonacci Retracement Indicator draws lines of support and resistance using key ratios from the Fibonacci sequence. These ratios reveal themselves frequently in nature, including trading. The swing high point is where you see an obvious change in a price trend from bullish to bearish. The swing low point is where you see an obvious reversal from bearish to bullish

Once you’ve identified these two points, you draw the Fibonacci indicator between the swing low and swing high if you’re trying to see how low the price will fall, and you draw the Fibonacci indicator between the swing high and the swing low if you’re trying to see how high price will go

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

📜 Disclaimer 📜

The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome.

#Bitcoin #trading #TA #charts #indicators #crypto