Published On Nov 18, 2019

Comparable sales approach does not work very well for valuing apartment buildings. Find out what does in this video! HINT: it has to do with the building's income.

My attorney profile:

https://www.woh.com/attorneys/79/vita...

My real estate brokerage website:

http://www.serenityrealestate518.com/

My blog:

http://www.succeedrei.com

Facebook pages:

/ succeedrei

/ serenity518

The three most common valuation methods for real estate are:

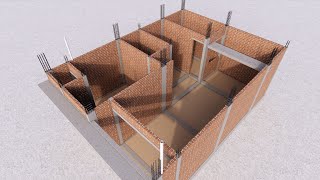

1. The Cost Approach

2. The Comparable Sales Approach

3. The Income Approach

The Cost Approach takes into account how much it would cost someone to build an identical property in the same location, using today's costs for labor and materials. This approach is not particularly accurate for older buildings, as current construction costs typically far exceed what any reasonable buyer would be willing to pay for any given property being valued.

The Comparable Sales Approach involves a comparison between the subject property and other similar properties that have sold in the same area in the very recent past. The comparable properties must be sufficiently similar in their features and attributes to the subject property, they must be in close geographic proximity (same street or neighborhood is best), and they must have sold within 6 to 12 months.

The Comparable Sales Approach works very well for single family homes and it works reasonably well for small multi-family homes (2-4 units). However, it begins running into challenges when attempting to use for valuation of 5+ unit buildings. The larger the multi-family property, the less likely it is that a comparable sales approach will work.

This is because, unlike single family homes and small multi-family properties, sales of larger multi-family properties are pretty rare. Even when you can find a few sales, they are not likely to be in the same neighborhood and within the sufficiently short time frame. For this reason, real estate investors and commercial lenders use the Income Approach.

There are actually two different income valuation methods: the Gross Rent Multiplier (GRM) method and the Capitalization Rate (Cap Rate) method. The GRM number is a number which is derived by examining the relationship between the gross rents and the prices of rental properties that have recently sold in the area. In order to calculate the GRM for any sold property, you simply have to take the sale price and divided by the gross annual rent that the property had at the time of sale. After you get the GRMs for several properties, you average them out to determine the average GRM. If you know your subject property's income, you can multiply it by the average GRM and that, in theory, would give you that property's value.

The problem with using the GRM method is that it does not take into account any expenses of the properties that were used to come up with the GRM number. Just because some properties have the same income, does not mean that they will be equally desirable to an investor. If the owner's expenses on one property are much higher than the other property, then the former property will be less desirable and thus less valuable. For this reason, the GRM is not the best income valuation method for valuing larger multi-family properties.

The Cap Rate method, on the other hand, does take into account a property's expenses. The Cap Rate method determines value by dividing a property's Net Operating Income (NOI) by the prevailing capitalization rate for the type of property in the area where the subject property is located.

NOI is calculated by subtracting all of property's expenses (except for the cost of mortgage) from the property's gross income. The capitalization rate can be determined by speaking to a commercial appraiser, commercial loan officer, or a commercial real estate agent. The higher the capitalization rate, the lower the value of the property will be and vice versa.

#SucceedREI

#ApartmentValuation

#CapRateValuation