Published On Jun 16, 2020

When it comes to early retirement the most important (and difficult) thing you have to grasp is your safe withdrawal rate.

FIRE bloggers rave about “the shockingly simple math behind early retirement,” but they almost never talk about the shockingly un-simple math behind safe withdrawal rates.

So this week, I invited Karsten Jeske, PhD – a former professor, Fed economist, quantitative finance researcher, and early retiree – to the podcast to share insight on how to estimate your safe withdrawal rate in retirement and how to mitigate sequence of returns risk.

This is the most important financial planning concept early retirees must grasp to stay retired and guarantee they never have to go back to a j-o-b.

What you’ll learn:

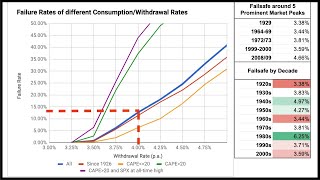

- The fatal flaw of the “4% rule” and why you might easily run out of money in retirement if you follow it blindly

- The importance of analyzing the conditional probability of failure based on the actual year you retire

- Why sequence of returns risk and safe withdrawals rates are inextricably linked

- Why the business cycle in the year you retire is crucial to your safe withdrawal analysis, plus how to use the Shiller CAPE ratio to estimate your safe withdrawal rate

- How Social Security factors into your safe withdrawal analysis

- Why sequence of returns risk is front-loaded for early retirees but back-loaded for wage earners

- How to adjust your withdrawal rate and rebalance your portfolio in response to market conditions

- How to critique the common advice that the returns risk in the first 10 years of retirement determine success or failure in all retirement

- Why sequence of returns risk is a “zero sum game” between retirees vs. savers, and why investing strategies for these two groups should therefore inversely mirror each other

- Concrete actions investors can take, during their accumulation phase and during retirement, to reduce sequence of returns risk

- How early retirees can use rental real estate to reduce sequence of returns risk

- What is the lowest historical safe withdrawal rate that entirely eliminated sequence of returns risk

- How coronavirus might impact your safe withdrawal analysis and early retirement prospects

Check it out here:

https://hackyourwealth.com/safe-withd...

https://hackyourwealth.com/safe-withd...

Have you analyzed your safe withdrawal rate? Do you think it is more or less than 4%? 3%? What actions do you plan to take to fortify your safe withdrawal rate? Let me know by leaving a comment when you’re done.

P.S. If you liked this episode, be sure to subscribe on Apple Podcasts so you don’t miss any upcoming episodes! 😎

https://hackyourwealth.com/itunes

P.P.S. Join us on Facebook!

https://hackyourwealth.com/fb