Published On May 9, 2023

If you're a real estate agent wondering "How do you file taxes as a real estate agent?", then you've come to the right place! In this video, we'll cover the essential information you need to know about filing taxes as a real estate agent, including the types of taxes you'll need to pay, options for setting up your business, and strategies to help lower your tax bill.

We'll dive into the following topics:

1. Types of taxes real estate agents pay - Understand the various taxes you'll need to pay as a real estate agent, such as income tax and self-employment tax.

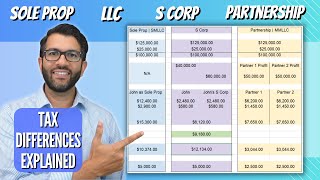

2. Business setup options for real estate agents - Learn about the different ways you can structure your real estate business, such as sole proprietorship or LLC, and S Corp and the tax implications of each option.

3. Strategies to lower your tax bill - Discover tax deductions specific to real estate agents that can help you save money on your tax bill, such as business-related expenses, home office deductions, and more.

Make sure you stay on top of your taxes by watching our guide on filing taxes as a real estate agent.

====

RESOURCES:

💡Tax and accounting help for your self-employed business: content.collective.com/getstarted

➡️ The Real Estate Agent’s Tax Guide for 2023 (Article): https://www.collective.com/blog/real-...

➡️ Tax Deductions for Real Estate Agents (Article): https://www.collective.com/guides/tax...

➡️ Tax Deductions for Real Estate Agents (Video): • Real Estate Agent Tax Deductions to M...

====

KEY MOMENTS:

00:00 Introduction

00:30 How Real Estate Agents are Taxed

00:48 Taxes Real Estate Agents Pay

01:13 Legal Structures for your Business

01:53 How S Corps Work

02:20 Common Tax Deductions

===

FOLLOW US:

Instagram: instagram.com/collectivedotcom/

LinkedIn: linkedin.com/company/collective/

Twitter: twitter.com/CollectiveFin