Published On Premiered Oct 23, 2023

Reach out for a proposal. Call or text (760) 473-5878.

Email - [email protected]

Website - juliansolarguide.com

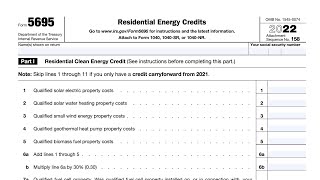

The ITC solar tax credit is one of the most confused topics when going solar. I receive the question almost on a daily basis. I think for the most part people understand how if you are a 1099 filer, the tax credit amount is simply subtracted off what you would normally owe.

For W2 earners, many tend to get confused about how if they are getting a refund check they could still be eligible for the tax credit. That is because the amount of the refund is a correction for the amount you already paid. It doesn't mean you have no tax liability. The refund is being subtracted off what you already paid to match the correct amount of tax that is due. Just because you overpaid and are getting a refund, doesn't mean your tax liability is nothing, as I explain in the video.

I am not a certified tax professional or CPA so please take this information and verify for yourself. With that being said, I’ve been doing this for over six years and have guided many people through and I’m very confident telling you this is how it works.

Would you like to get started with a consultation? If so, then please fill out the form in the link below. Once received, my assistant Cody will call you back afterwards to explain next steps in receiving a thorough consultation and quote from us. Thank you for watching the channel.

https://form.jotform.com/230316991463155