Published On Mar 24, 2019

Support the channel by getting The Interpretation of Financial Statements by Benjamin Graham here: https://amzn.to/2LrTbq5

As an Amazon Associate I earn from qualified purchases.

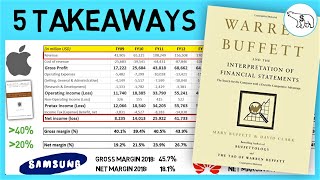

Fundamental analysis & value investing 101. This video presents the 5 greatest takeaways from Benjamin Graham’s classic, The Interpretation of Financial Statements.

A playlist that will help you in mastering Benjamin Graham’s art of Value Investing: http://bit.ly/2Txvxgd

Top 5 takeaways from Benjamin Graham’s The Interpretation of Financial Statements:

00:00 Intro

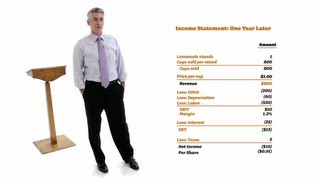

02:04 1. Understanding the Income Statement and the Balance Sheet

05:13 2. Industry Specifics

07:53 3. Watered Stocks

09:35 4. The Liquidation Value of a Firm

11:29 5. Expected Returns of the Quantitative Investor

TL;DW:

- Know thy income statement and balance sheet

- Ratios are useful when considering the fundamentals of a company, but beware. If the numbers are healthy or not depends on the industry.

- It’s quite common that stocks are “watered” to look like they perform better than they actually do

- If a stock is priced lower than its current book value, the intelligent investor should take a closer look. This, could be a great value investing opportunity

- To achieve maximum portfolio returns, the value investor should do both a quantitative and qualitative analysis of his stock market investments

My goal with this channel is to help you make more money and improve your personal finances. How to become a millionaire? There are many ways to get there – investing in the stock market, becoming a stock trader, doing real estate investing, or why not becoming an entrepreneur? But whether you are interested in how to invest in stocks or investing strategies for creating passive income with rental properties – I hope to be able to provide you with a solution (or at least an idea) here. Warren Buffett - the greatest investor of our time - says that you should fill your mind with competing ideas and then see what makes sense to you. This channel is about filling your mind with those ideas. And in the process – upgrading your money-making toolbox.