Published On Apr 1, 2022

Accounting is the language of business. Much like you cannot understand what type of dish you are ordering if you don't know the language of the menu, you cannot understand what type of business you are buying in the stock market if you don't know financial statements.

By the way, don't worry. You don't need a college degree in accounting or math for this. You just need to listen to how Bob makes shady deals with the Swedish Mars Mafia and how he beats his second Cousin Stephan to build the first empire of restaurants on the red planet.

---

My main tool for fundamental screening and analysis of stocks: https://app.tikr.com/register?ref=tsi

(If you sign up I earn a small commission)

---

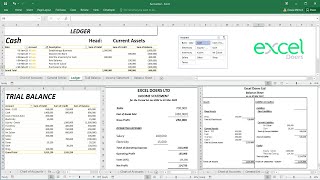

Timestamps for understanding the financial statements:

00:00 Intro

00:22 The Language of Business

01:43 Issuing Common Stock

01:55 Important Difference Between the Statements

02:28 Cash & Equivalents

02:40 The Accounting Equation

04:41 Long-Term Debt

05:02 Property, Plant & Equipment

05:31 Current VS Long-Term Assets

07:40 Cost of Goods Sold (COGS)

07:57 The Income Statement

08:15 Gross & Net Income

08:34 Selling, General & Admin Expenses (SG&A)

09:43 COGS or SG&A?

10:20 Introduction to Depreciation

11:28 Capitalization

12:02 Depreciation & Amortization

12:45 Accumulated Deprecation

13:05 The Importance of Profit Margins

13:43 Interest Expenses

13:53 Income Tax Expense

14:11 Retained Earnings

14:21 The Cash Flow Statement

14:39 How the Statements are Linked

15:00 Cash from Operations

15:31 Cash from Investing

16:01 Capital Expenditures

16:16 Cash from Financing

16:28 Net Change in Cash

16:58 Only the Balance Sheet Accumulates

17:30 The “Stickiness” of Expenses

18:16 Inventory

18:26 Change in Net Working Capital

20:02 Research & Development (R&D)

20:36 Freeing up Cash

21:10 Collateral & Defaults

21:40 Debt/Equity Ratio

22:08 Issuing More Stock (Equity)

22:50 Equity VS Debt

23:29 Additional Paid in Capital

23:43 Other Intangibles

24:14 Amortization of Intangible Assets

24:35 Expanding the Costs

25:22 Major Expansion & Expenses

25:45 Accounts Payable

25:58 Accounts Receivables

26:39 Accrued Expenses

27:06 Dividends

27:58 Repurchasing Shares

28:40 Treasury Stock

29:12 Acquisitions

29:45 Goodwill

30:18 Short-Term Investments

---

My goal with this channel is to help you make more money and improve your personal finances. How to become a millionaire? There are many ways to get there – investing in the stock market, becoming a stock trader, doing real estate investing, or why not becoming an entrepreneur? But whether you are interested in how to invest in stocks or investing strategies for creating passive income with rental properties – I hope to be able to provide you with a solution (or at least an idea) here. Warren Buffett - the greatest investor of our time - says that you should fill your mind with competing ideas and then see what makes sense to you. This channel is about filling your mind with those ideas. And in the process – upgrading your money-making toolbox.